CHISD's Financial Status

Chapel Hill ISD was given an A rating in 2022-2023 Financial Accountability for the 19th year in a row. The School Financial Integrity Rating System of Texas is led by Texas Education Agency.

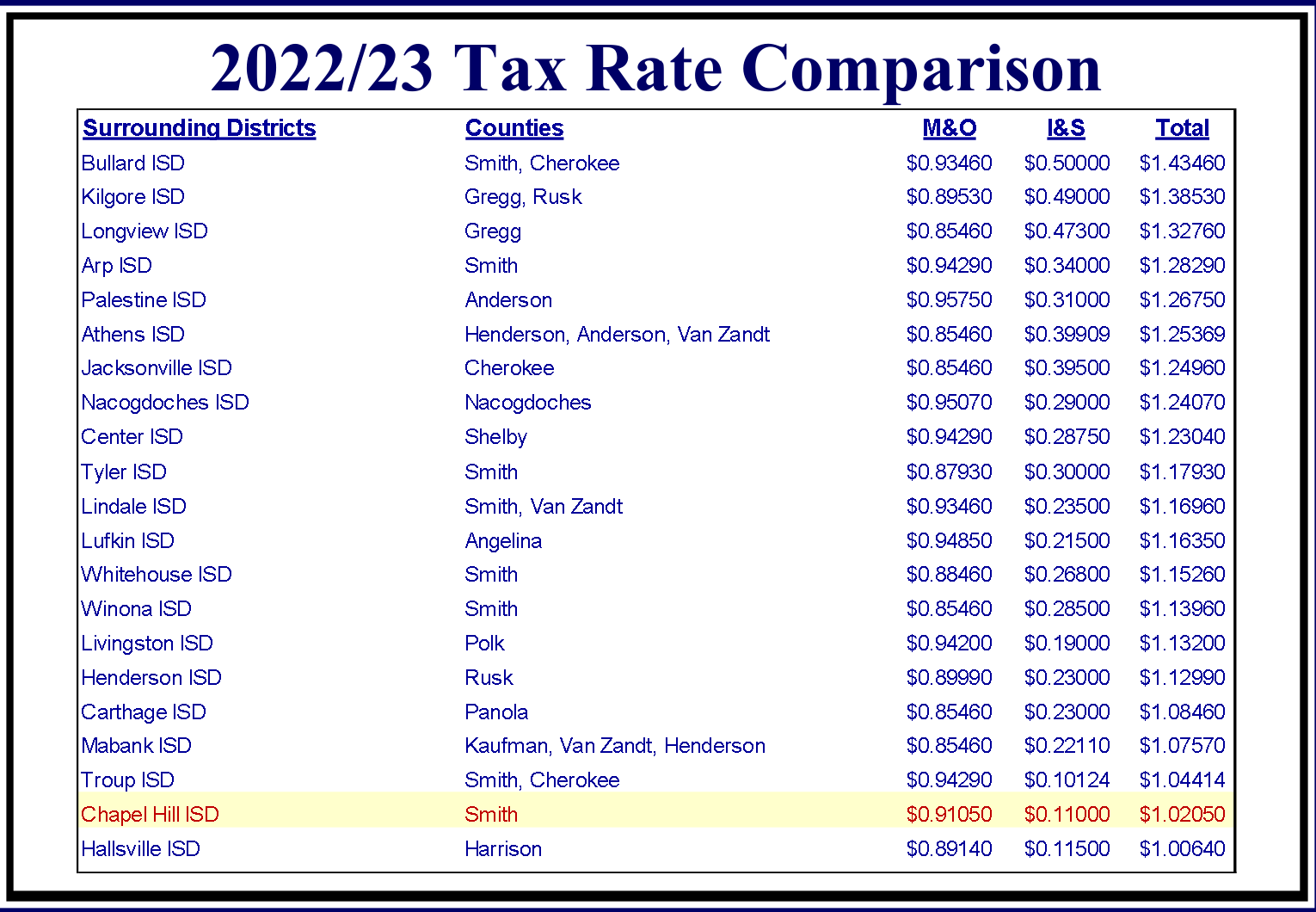

Tax Breakdown for Chapel Hill - Smith County

What if I'm over the age of 65?

Voters over the age of 65 who own a home with a homestead exemption will see a zero tax impact on their property.

Other Tax Exemptions:

General Residential

Disabled Veteran

Survivors of a Disabled Veteran

What's my proposed tax impact?

Click the 'up' and 'down' arrows to match the value of your home and calculate your proposed monthly tax increase.